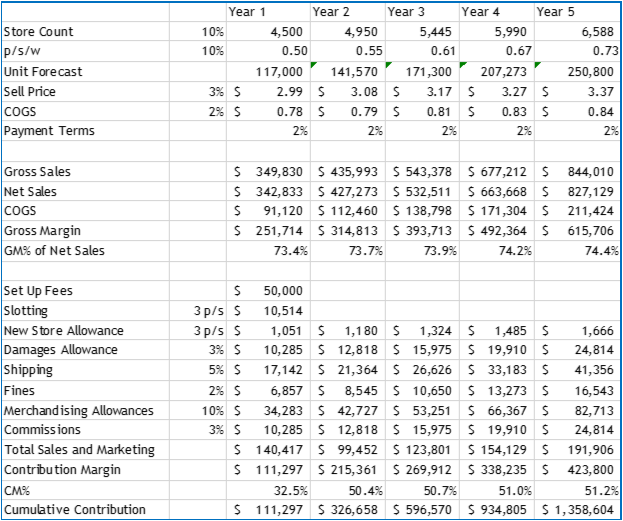

PROFIT AND LOSS MANAGEMENT is not a luxury in the CPG world. Every decision has an impact on the profitability of the business and can be either incremental or decremental to the contribution margin or net profit of the company. Every modern sales and marketing manager needs to understand basic profit and loss statements so that they can properly assess the impact of a decision as they are making them. The following example is a simple P&L designed to demonstrate the contribution margin associated with sales or marketing activity.

Contribution Margin is the margin after variable expenses that go toward, or contribute to, the fixed overhead and profit of a company or business unit.

Though each business will vary, if we assume that the SG&A expenses and other fixed costs are 25% of this business’ total Net Sales, then this P&L with it contribution margin of ~50% means that the net income generated from this business would be approximately 25%.

Using the contribution model P&L is useful in that it allows the sales or marketing manager to make a business decision without having to be an accountant and get involved with calculating the SG&A, amortization, depreciation, interest, taxes, etc. Of course, if investment in new capital equipment is required for this new business, then the cost of that capex might need to be included.

A simple model such as this will provide valuable insight into the decision making process.